What is the best way to handle money?

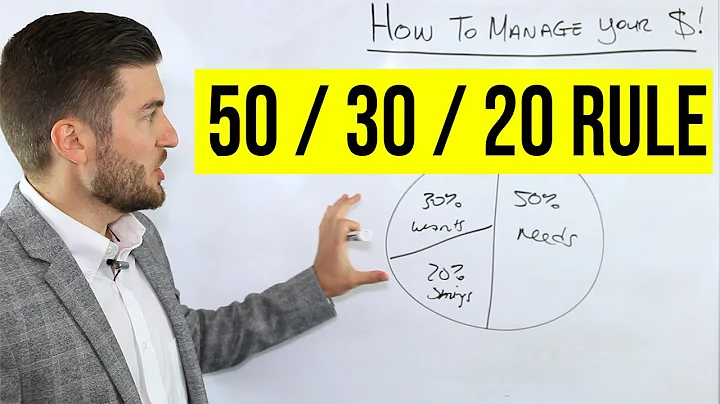

Those will become part of your budget. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

- Assemble a team of trusted financial professionals. A large sum of money brings plenty of important financial decisions. ...

- Adjust to sudden wealth by creating a financial plan. ...

- Take time to determine your values and financial goals for your sudden wealth.

- Create a Budget. ...

- Visualize What You're Saving For.

- Always Shop with a List. ...

- Nix the Brand Names. ...

- Master Meal Prep.

- Consider Cash for In-store Shopping. ...

- Remove Temptation.

- Hit “Pause"

- Figure out your income sources. ...

- Get clear on your priorities, needs, and wants. ...

- Create a budget. ...

- Create a no-stress plan for paying your bills. ...

- “Bank” smart. ...

- Keep it secure. ...

- Avoid credit card debt. ...

- Get help fast when you need it.

Those will become part of your budget. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

A financial advisor can help you invest your money, plan for major life events and preserve your wealth for future generations of your family. However, some people have the time and know-how to manage their money and create a financial plan suited to their needs.

Investing in financial markets can be a great way to put your money to work, but it's important to do so in a way that is consistent with your risk tolerance. Work with a financial advisor to determine your tolerance for risk and develop an investment strategy.

Methods of saving include putting money in, for example, a deposit account, a pension account, an investment fund, or kept as cash. In terms of personal finance, saving generally specifies low-risk preservation of money, as in a deposit account, versus investment, wherein risk is a lot higher.

Steps to Feel More Secure Financially

First, go through your budget and make sure you know exactly where your money is going. Knowing these details will give you a sense of control, which will help you feel empowered with your next move. Once you know where the money is going, look to reduce discretionary spending.

You can stop the cycle of overspending in a variety of ways, including creating and sticking to a budget, planning your purchases (whether a big-ticket item or just weekly groceries), using cash, and going on a spending freeze.

What is your biggest financial goal?

The biggest long-term financial goal for most people is saving enough money to retire. The common rule of thumb is that you should save 10% to 15% of every paycheck in a tax-advantaged retirement account like a 401(k) or 403(b), if you have access to one, or a traditional IRA or Roth IRA.

Are you approaching 30? How much money do you have saved? According to CNN Money, someone between the ages of 25 and 30, who makes around $40,000 a year, should have at least $4,000 saved.

Your priority is creating a realistic budget that works for you; saving 10% of your paycheck, or even just $10 or $20 a week, will build up over time. If your needs are less than 50% of your income, you have an opportunity to put more money into savings and investments.

How much should you save each month? For many people, the 50/30/20 rule is a great way to split up monthly income. This budgeting rule states that you should allocate 50 percent of your monthly income for essentials (such as housing, groceries and gas), 30 percent for wants and 20 percent for savings.

1. Spend less than you make. This may seem obvious, and boring, but spending less than you make is by far the biggest key to financial success. If you struggle with spending, focus on this one rule until you're at a point where you have positive cash flow at the end of the month.

- Make a list of your values. Write down what matters to you and then put your values in order.

- Set your goals.

- Determine your income. ...

- Determine your expenses. ...

- Create your budget. ...

- Pay yourself first! ...

- Be careful with credit cards. ...

- Check back periodically.

For all those reasons, billionaires typically rely on a team of financial experts, including tax specialists, estate planners, investment strategists and security advisors, to navigate their financial landscape effectively.

- Know where your money goes. Look back over your spending and categorize where your money has gone, for example on gas, home repairs, and eating out. ...

- Create a budget. ...

- Identify quick wins. ...

- Set up multiple accounts. ...

- Remember to save. ...

- Set up recurring payments. ...

- Limit credit card use.

Put extra cash into your emergency fund.

The general guideline is to accumulate three to six months' worth of household expenses. Consider putting it in a high yield savings or money market account, which typically earn more interest than a traditional savings account.

The premise of the 30-day savings rule is straightforward: When faced with the temptation of an impulse purchase, wait 30 days before committing to the buy. During this time, take the opportunity to evaluate the necessity and impact of the purchase on your overall financial goals.

What is the 3 saving rule?

This model suggests allocating 50% of your income to essential expenses, 15% to retirement savings and 5% to an emergency fund. This plan allows you to meet your immediate needs and plan for the future before you spend on anything else.

Make a budget and make saving a necessary expense. Try out different budgeting methods until you find one you can stick to. Cut down on spending. Use budgeting apps to find out where you're money is going and look for places where you can cut back.

- Schedule a money check-in: Set a financial goal for yourself to save a set amount by a specific date. ...

- Create a household budget: Putting your income and expenses on paper will show you exactly where your money is going so you can take control of your spending.

It may be that you have too much credit card debt, not enough income, or you overspend on unnecessary purchases when you feel stressed or anxious. Or perhaps, it's a combination of problems. Make a separate plan for each one.

And because being wealthy is subjective, some Americans might also believe that being financially comfortable is identical to being wealthy. Specifically, participants in Schwab's survey reported that a net worth of $774,000 or more means being comfortable.

References

- https://education.savvymoney.com/saving/are-you-financially-comfortable/

- https://www.roberthalf.com/jp/en/insights/landing-job/6-reasons-finance-professionals-love-their-jobs

- https://business.wfu.edu/mba/articles/need-to-be-good-at-math-for-mba/

- https://training-you.fr/the-most-and-least-stressful-jobs-in-banking-and-finance/

- https://uk.indeed.com/career-advice/interviewing/why-do-you-want-to-work-in-finance

- https://www.peakframeworks.com/post/no-job-to-finance

- https://www.investopedia.com/articles/financialcareers/08/five-undergrad-tips.asp

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.cdc.gov/violenceprevention/about/copingwith-stresstips.html

- https://www.investopedia.com/articles/basics/11/become-self-taught-finance-expert.asp

- https://timespro.com/blog/why-do-you-want-to-work-in-the-banking-sector-we-give-you-the-reasons

- https://www.naukri.com/blog/why-should-i-hire-you/

- https://www.wgu.edu/blog/finance-degree-difficult2301.html

- https://300hours.com/is-finance-a-good-career-path/

- https://emeritus.org/blog/finance-highest-paying-jobs-in-finance/

- https://www.stash.com/learn/how-much-of-your-paycheck-should-you-save/

- https://www.gcu.edu/blog/business-management/bachelor-science-finance-right-me

- https://corporatefinanceinstitute.com/resources/wealth-management/what-is-finance-definition/

- https://www.bankrate.com/banking/savings/30-day-savings-rule/

- https://www.robertwaltersgroup.com/news/expert-insight/careers-blog/six-expert-tips-for-your-next-finance-interview.html

- https://www.usbank.com/wealth-management/financial-perspectives/financial-planning/extra-cash.html

- https://www.1stunitedcu.org/more-for-you/financial-wellness/dealing-with-financial-anxiety--how-to-decrease-stress-around-money

- https://online.maryville.edu/online-bachelors-degrees/finance/careers/why-major-in-finance/

- https://uk.indeed.com/career-advice/interviewing/why-finance-interview-question

- https://www.sofi.com/learn/content/how-to-stop-spending-money/

- https://www.reddit.com/r/finance/comments/3gqz78/why_corporate_finance/

- https://future-business.org/what-are-the-five-goals-for-business-finance/

- https://topworkplaces.com/highest-paying-finance-jobs/

- https://www.forbes.com/advisor/education/business-and-marketing/careers-in-finance/

- https://www.wikijob.co.uk/interview-advice/interview-questions/interview-question-why-finance

- https://ca.indeed.com/career-advice/interviewing/why-finance-interview-questions

- https://www.forbes.com/advisor/banking/savings/clever-ways-to-save-money/

- https://online.hbs.edu/blog/post/finance-skills-employers-look-for-on-a-resume

- https://www.thewallstreetschool.com/blog/why-choose-career-in-finance/

- https://www.johnhanco*ck.com/ideas-insights/budgeting-rules-to-help-save-money.html

- https://www.ziprecruiter.com/Salaries/Finance-Salary--in-California

- https://www.bankrate.com/banking/savings/how-much-money-should-i-save-each-month/

- https://en.wikipedia.org/wiki/Saving

- https://www.investopedia.com/articles/personal-finance/100516/setting-financial-goals/

- https://www.investopedia.com/articles/economics/11/difference-between-finance-and-economics.asp

- https://pursuethepassion.com/why-are-you-passionate-about-finance/

- https://www.helpguide.org/articles/stress/coping-with-financial-stress.htm

- https://smartasset.com/financial-advisor/should-i-use-a-financial-advisor-or-do-it-myself

- https://www.sunshineccu.com/smart-spending-is-the-secret-to-financial-wellness

- https://www.investopedia.com/articles/financialcareers/08/beat-tough-interviews.asp

- https://www.michaelpage.co.uk/advice/career-advice/job-interview-tips/why-do-you-want-this-job-examples

- https://www.regions.com/insights/personal/personal-finances/creating-a-financial-plan/money-management-what-to-do-with-a-lump-sum

- http://mappingyourfuture.org/money/budget.cfm

- https://www.investopedia.com/ask/answers/what-is-finance/

- https://www.investopedia.com/articles/financial-careers/08/financial-career-options-professionals.asp

- https://www.indeed.com/career-advice/career-development/field-of-finance

- https://www.usbank.com/wealth-management/financial-perspectives/financial-planning/financial-windfall.html

- http://www.sa.ucsb.edu/resources/student-financial-guide/money-management-basics

- https://finance.yahoo.com/news/know-im-rich-140000452.html

- https://work.chron.com/five-good-strengths-finance-interview-6133.html

- https://www.topuniversities.com/courses/accounting-finance/accounting-vs-finance-which-should-you-study

- https://www.intelligent.com/best-finance-degree-programs/

- https://www.britannica.com/money/finance

- https://bau.edu/blog/finance-vs-economics-major/

- https://www.indeed.com/career-advice/finding-a-job/what-do-finance-majors-do

- https://www.pnc.com/insights/personal-finance/save/how-to-stop-spending-money.html

- https://research.com/careers/is-finance-a-good-career-path

- https://money.usnews.com/financial-advisors/articles/how-financial-advisors-work-with-billionaires

- https://mergersandinquisitions.com/is-finance-a-good-career-path/

- https://www.towson.edu/cbe/departments/finance/whystudy.html

- https://www.fedfinance.ca/en/news/answering-the-5-strengths-and-weaknesses-question-in-a-finance-job-interview

- https://www.treyton.com/post/5-golden-rules-of-personal-finance

- https://localfirstbank.com/article/how-much-money-should-i-have-saved-by-the-time-i-am-30/