What is the 20 40 rule in finance?

Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

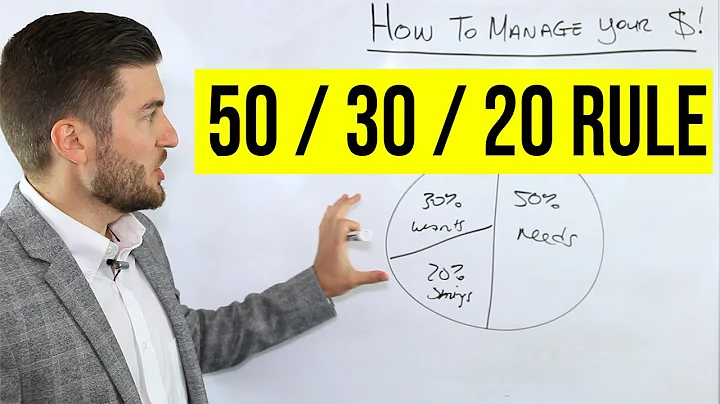

The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).

30% should go towards discretionary spending (such as dining out, entertainment, and shopping) - Hubble Money App is just for this. 20% should go towards savings or paying off debt. 10% should go towards charitable giving or other financial goals.

If you have a large amount of debt that you need to pay off, you can modify your percentage-based budget and follow the 60/20/20 rule. Put 60% of your income towards your needs (including debts), 20% towards your wants, and 20% towards your savings.

YOUR BUDGET

The 80/20 budget is a simpler version of it. Using the 80/20 budgeting method, 80% of your income goes toward monthly expenses and spending, while the other 20% goes toward savings and investments.

If you want to be sure you're saving enough for retirement, the 25x rule can help. This rule of thumb says investors should have saved 25 times their planned annual expenses by the time they retire, according to brokerage Charles Schwab.

- 50% for mandatory expenses = $2,000 (0.50 X 4,000 = $2,000)

- 30% for wants and discretionary spending = $1,200 (0.30 X 4,000 = $1,200)

- 20% for savings and debt repayment = $800 (0.20 X 4,000 = $800)

What is the Rule of 69? The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result.

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

In his free webinar last week, Market Briefs CEO Jaspreet Singh alerted me to a variation: the popular 75-15-10 rule. Singh called it leading your money. This iteration calls for you to put 75% of after-tax income to daily expenses, 15% to investing and 10% to savings.

What is the 30 rule in finance?

The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings. Learn more about the 50/30/20 budget rule and if it's right for you.

The Rule of 120 (previously known as the Rule of 100) says that subtracting your age from 120 will give you an idea of the weight percentage for equities in your portfolio.

When following the 10-10-80 rule, you take your income and divide it into three parts: 10% goes into your savings, and the other 10% is given away, either as charitable donations or to help others. The remaining 80% is yours to live on, and you can spend it on bills, groceries, Netflix subscriptions, etc.

It says your total debt shouldn't equal more than 20% of your annual income, and that your monthly debt payments shouldn't be more than 10% of your monthly income. While the 20/10 rule can be a useful way to make conscious decisions about borrowing, it's not necessarily a useful approach to debt for everyone.

The Pareto principle states that for many outcomes, roughly 80% of consequences come from 20% of causes. In other words, a small percentage of causes have an outsized effect. This concept is important to understand because it can help you identify which initiatives to prioritize so you can make the most impact.

This is what the 80/20 rule teaches you. Generally, when in a relationship you get about 80% of what you want. This sounds pretty good because it's such a high percentage. However, we are also craving that other 20%.

One simple rule of thumb I tend to adopt is going by the 4-3-2-1 ratios to budgeting. This ratio allocates 40% of your income towards expenses, 30% towards housing, 20% towards savings and investments and 10% towards insurance.

The Rule of 72 is a calculation that estimates the number of years it takes to double your money at a specified rate of return. If, for example, your account earns 4 percent, divide 72 by 4 to get the number of years it will take for your money to double. In this case, 18 years.

One of the key rules within my unique Income Method is the Rule of 42 - holding at least 42 income-generating investments that enable you to have reduced risk from any individual holding.

- Sell Private Label Rights (PLR) products 📝

- Start a dropshipping online business 📦

- Start a blog and leverage ad income 💻

- Freelance your skills 🎨

- Fulfillment By Amazon (FBA) 📚

- Flip vintage apparel, furniture, and decor 🛋

Is $10,000 enough for a month?

10,000 depends on your individual circ*mstances, financial goals, and priorities. However, here is a general guideline that you could consider: 1. Fixed expenses: Start by allocating a portion of your income to fixed expenses such as rent, utility bills, transportation, and insurance.

This brings us to the question -- can a retired person live on $4,000 a month? The answer is yes, almost 1 in 3 retirees today are spending between $2,000 and $3,999 per month, implying that $4,000 is a good monthly income for a retiree.

The relationship can be referred to as the “Rule of 21,” which says that the sum of the P/E ratio and CPI inflation should equal 21. It's not a perfect relationship, but holds true generally.

The Rule of 78 formula

The lender allocates a fraction of the interest for each month in reverse order. For example, you would pay 12/78 of the interest in the first month of the loan, 11/78 of the interest in the second month and so on. The result is that you pay more interest than you should.

The formula for the Rule of 144 is, 144 divided by the interest rate equal to the number of years it will take to quadruple your money. For instance: If you invest Rs 1,00,000 with a 12% annual expected return, then the time by which it will gain four times is 144/12 = 12 years.

References

- https://www.thelangelfirm.com/debt-collection-defense-blog/2018/august/100-examples-of-the-80-20-rule/

- https://finance.yahoo.com/news/why-50-30-20-budget-120032412.html

- https://insights.masterworks.com/finance/the-20-10-rule-for-debt-management/

- https://www.cnbc.com/select/how-much-money-you-should-save-every-paycheck/

- https://extension.umd.edu/resource/applying-pareto-principle-your-marketing-8020-rule

- https://www.lendingtree.com/debt-consolidation/credit-card/fastest-way-to-pay-off-5000-debt/

- https://www.laurelroad.com/resources/budget-calculator/

- https://www.techtarget.com/whatis/definition/Pareto-principle

- https://www.youthentity.org/step-5-budgeting

- https://money.usnews.com/investing/articles/the-rule-of-72

- https://www.quora.com/Whats-the-20-80-rule-in-a-relationship

- https://www.cnbc.com/select/how-to-pay-off-credit-card-debt/

- https://trainingindustry.com/wiki/content-development/the-702010-model-for-learning-and-development/

- https://www.bankrate.com/loans/personal-loans/rule-of-78/

- https://www.kellycommunity.org/gen_z_articles/the-80-10-10-budget/

- https://money.usnews.com/money/retirement/articles/what-is-the-25x-rule-for-retirement-saving

- https://myhubble.money/blog/the-40-30-20-10-rule-to-saving-and-spending-money

- https://www.myhubble.money/blog/the-40-30-20-10-rule-to-saving-and-spending-money

- https://hyperjar.com/blog/the-70-20-10-rule

- https://www.primerica.com/public/rule-of-72.html

- https://moneytalks101.substack.com/p/what-is-your-money-plan

- https://seekingalpha.com/article/4680124-save-your-retirement-with-the-rule-of-42

- https://www.investopedia.com/ask/answers/040915/what-considered-good-net-debttoequity-ratio.asp

- https://m.economictimes.com/wealth/invest/what-is-the-rule-of-72-in-investing-5-things-to-know/articleshow/98035362.cms

- https://medium.com/finance-for-everyday-life/6-common-budget-mistakes-you-cant-afford-to-make-b452dc3bcf50

- https://www.johnhancock.com/ideas-insights/budgeting-rules-to-help-save-money.html

- https://www.linkedin.com/pulse/4-3-2-1-approach-financial-freedom-royston-tan-%E9%99%88%E9%9F%A6%E9%BE%99-chfc-asep-ibfa-

- https://asana.com/resources/pareto-principle-80-20-rule

- https://news.cleartax.in/personal-investment-rule-of-72-114-and-144-explained/9099/

- https://www.cbsnews.com/news/how-long-will-it-take-to-pay-off-5000-in-credit-card-debt/

- https://cozinhacabral.com/20-10-rule-to-calculate-debt-limits/

- https://www.globalatlantic.com/professionals/thriving-practice/market-insights/rule-120

- https://finance.yahoo.com/news/grant-cardone-swears-40-40-110053843.html

- https://coinswitch.co/switch/indian-stocks/what-is-the-7-10-rule-in-investing/

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://www.nasdaq.com/articles/grant-cardone-swears-by-the-40-40-20-rule%3A-i-guarantee-youll-create-wealth-for-yourself

- https://www.tiaa.org/public/learn/personal-finance-101/how-much-of-my-income-should-i-save-every-month

- https://www.self.inc/blog/how-much-money-should-I-save-by-30

- https://www.thebalancemoney.com/should-you-follow-the-20-10-rule-for-debt-management-4164476

- https://www.accountingtools.com/articles/rule-of-69

- https://www.financialexpress.com/market/rule-1-never-lose-money-warren-buffetts-most-famous-buffettisms-or-investing-rules-3080177/

- https://www.experian.com/blogs/ask-experian/what-is-the-20-10-rule/

- https://www.forbes.com/advisor/banking/budget-calculator/

- https://www.citizensbank.com/learning/how-much-debt-is-too-much.aspx

- https://www.cbsnews.com/news/how-long-will-it-take-to-pay-off-10000-in-credit-card-debt/

- https://www.usnews.com/banking/articles/your-retirement-account-is-not-a-savings-account

- https://study.com/academy/lesson/three-cs-of-credit-character-capital-capacity.html

- https://finance.yahoo.com/news/25-best-cities-where-retire-051546942.html

- https://www.nasdaq.com/articles/dave-ramsey:-heres-how-much-money-you-should-have-in-savings

- https://www.citizensbank.com/learning/50-30-20-budget.aspx

- https://blog.startupstash.com/how-can-the-80-20-rule-boost-an-investors-portfolio-ed6f5066d59e

- https://www.earnest.com/blog/rent-and-the-30-percent-rule/

- https://www.linkedin.com/pulse/pareto-8020-principle-how-supports-coaching-leader-teams-cunningham

- https://www.loqbox.com/en-gb/blog/70-20-10-rule-for-money-budgets-as-seen-on-tiktok

- https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/is-the-60-30-10-budget-rule-replacing-the-50-30-20-experts-hope-not

- https://hiatusapp.com/learn/hiatus-guides/70-20-10-budget-rule-what-it-is/

- https://investmentinsight0.quora.com/If-your-income-is-Rs-10-000-how-do-you-spend-it-monthly-and-how-do-you-save?top_ans=8283064

- https://brainly.in/question/15177196

- https://www.opploans.com/oppu/financial-literacy/80-20-budget/

- https://www.vsecu.com/blog/the-power-of-seven-a-complete-guide-to-the-seven-percent-savings-rule/

- https://www.easygenerator.com/en/blog/learning-approach/70-20-10-origins-criticisms/

- https://money.usnews.com/money/personal-finance/spending/articles/how-the-70-20-10-budget-rule-works

- https://www.docebo.com/glossary/70-20-10/

- https://www.bankrate.com/investing/what-is-the-rule-of-72/

- https://www.fa-mag.com/news/financial-planning-is-top-of-mind-for-millionaires--study-says-74597.html

- https://homework.study.com/explanation/the-budget-should-always-be-prepared-first.html

- https://www.linkedin.com/pulse/50-activities-use-70-20-10-model-sean-mcpheat

- https://www.investopedia.com/terms/f/five-c-credit.asp

- https://www.linkedin.com/pulse/5-rules-decision-making-using-8020-principle-ron-vereggen

- https://702010institute.com/702010-model/

- https://www.aafp.org/pubs/fpm/issues/2000/0900/p76.html

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://wallethub.com/answers/cc/how-to-pay-off-2000-in-credit-card-debt-1000294-2140754586/

- https://www.investopedia.com/ask/answers/12/reasonable-amount-of-debt.asp

- https://www.investopedia.com/financial-edge/0210/rules-that-warren-buffett-lives-by.aspx

- https://www.prudential.com/financial-education/4-percent-rule-retirement

- https://www.beachhousewealth.com/article-the-20-20-60-rule

- https://www.bible.com/events/39014

- https://www.forbes.com/sites/kevinkruse/2021/10/04/move-over-70-20-10-rule-3-to-1-is-the-new-model-for-learning/

- https://www.nasdaq.com/articles/10-money-rules-to-build-life-changing-wealth-according-to-ramit-sethi

- https://www.jsb.bank/resources/how-to-create-a-budget

- https://ancora.net/wp-content/uploads/The-Rule-of-21-6-15.pdf

- https://finance.yahoo.com/news/10-money-rules-build-life-160025454.html

- https://www.cbsnews.com/news/great-ways-to-pay-off-20000-in-credit-card-debt/

- https://www.jamescole.co/blog/what-is-the-70-20-10-rule-for-money

- https://www.linkedin.com/pulse/dont-perfect-good-enough-pareto-principle-8020-rule-tom-payani

- https://www.quicken.com/blog/10-20-rule-for-budgeting/

- https://relayfi.com/blog/how-to-make-10k-per-month

- https://www.investopedia.com/articles/investing/093015/why-saving-10-isnt-enough-get-you-through-retirement.asp

- https://www.pnc.com/insights/personal-finance/spend/four-common-budgeting-mistakes-how-to-avoid-them.html

- https://www.ucfcu.org/learn/financial-corner/50-20-20-10-budget

- https://www.philvenables.com/post/the-80---20-principle

- https://finance.yahoo.com/personal-finance/how-to-save-10000-in-a-year-211127729.html

- https://localfirstbank.com/article/how-much-money-should-i-have-saved-by-the-time-i-am-30/

- https://www.cmgroupuk.com/news-and-advice/faq-on-credit-control-prioritising-collections/

- https://www.nasdaq.com/articles/the-10-10-80-rule:-is-this-savings-system-best-for-you

- https://www.fidelity.com/viewpoints/personal-finance/spending-and-saving

- https://www.forbes.com/advisor/banking/guide-to-50-30-20-budget/

- https://www.sofi.com/learn/content/70-20-10-rule/

- https://www.opers.org/financial-wellness/50-20-30-calculator/

- https://www.investopedia.com/terms/1/80-20-rule.asp

- https://www.cbsnews.com/news/how-to-pay-off-20000-in-credit-card-debt-in-3-years-or-less/

- https://eringobler.com/80-20-rule/

- https://thebudgetnista.com/what-is-the-golden-rule-of-saving-money/

- https://www.range.com/blog/pay-yourself-first-following-the-80-20-budget